The Board of Directors (the "Board") for Fort Bend County Municipal Utility District No. 24 (“MUD 24” or the "District") has called for three (3) bond propositions to be on the election ballot for Saturday, May 1, 2021.

To ensure that residents and other constituents of the District have accurate information regarding the bond propositions and the goals for the District, answers to common questions have been compiled. This page will be updated to address additional questions and provide further information prior to the election.

What is Fort Bend County Municipal Utility District No. 24?

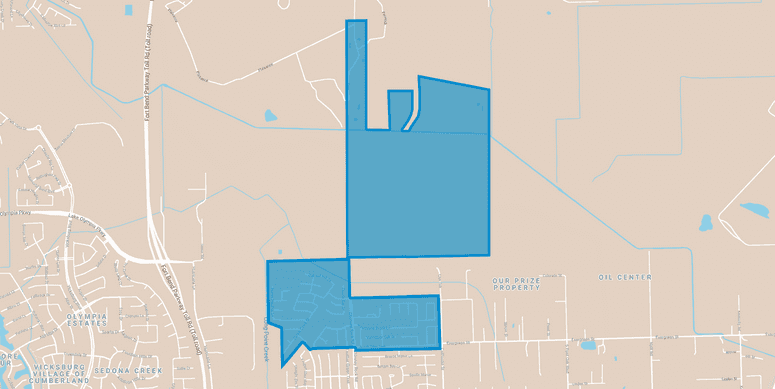

MUD 24 is a municipal utility district created in 1978 by order of the Texas Commission on Environmental Quality for the purpose of providing water, sanitary sewer, drainage and other services to its residents. The District contains approximately 774 acres of land located in Fort Bend County along Chimney Rock Rd and future Lake Olympia Pkwy.

Current District Map

What are the immediate goals of the District?

MUD 24 has two immediate goals for the District.

Road Accessibility Projects

The first goal is to partner with Fort Bend County to facilitate and complete road accessibility projects that directly affect District residents. Completion of these projects will alleviate ongoing congestion occurring during peak traffic times throughout the District. These projects include widening existing thoroughfares and arterials and construction of new segments as needed. The MUD 24 Board has prioritized these projects out of a concern for ease of access and the safety of District residents.

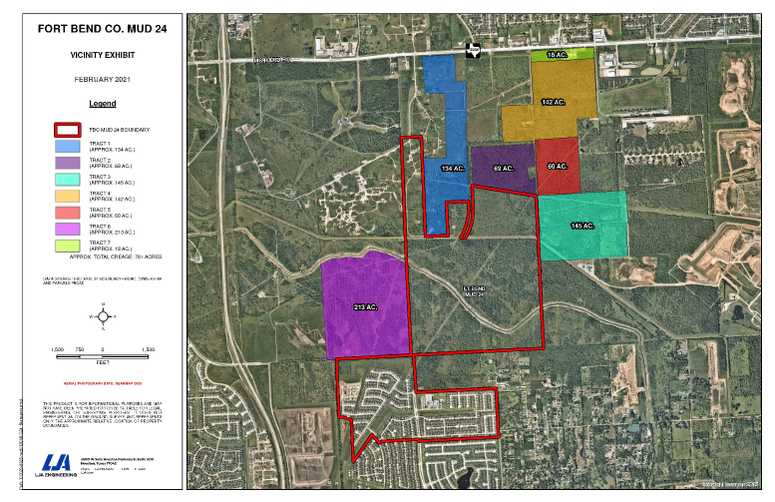

Annexation and Development

The second goal of the District is to annex land and develop these lands primarily for single family residential use. This future development would consist of water supply lines and facilities, sanitary sewer lines and facilities and drainage facilities for the areas. See the map below for potential tracks of land being considered.

How does the District plan to achieve these goals?

The MUD 24 Board has called for a bond election on the May 1, 2021 ballot to address the needs of the District.

- To fund the District portion of the road projects, MUD 24 would need bond authorization from District residents in the amount of $17,380,000.

- To fund the development of these annexation tracts, MUD 24 would need an additional $108,650,000 in Water, Sewer and Drainage bond authorization from District residents.

What is a bond authorization?

A bond authorization is an approval process to authorize the MUD 24 Board to sell bonds at future dates to fund District projects. It is similar to a line of credit that a business might use to fund its operations. An authorization is not immediate funding, nor is it a “blank check” to fund projects without meeting strict regulatory requirements. While an authorization may be approved for a large amount, bonds may only be sold if and when necessary projects are ready to begin.

Didn’t we already vote on a road bond authorization?

In November 2019 the District held an election for road bond authorization. 57% of District residents voted in favor of the road bond proposition. However, per Texas State law, the proposition must receive at least 67% (two-thirds) voter authorization in order for the District to be authorized to issue road bonds. For this reason, the District is once again placing the proposition on the ballot for the upcoming election to prioritize the joint road accessibility projects with Fort Bend County.

What will the road bond authorization be used for?

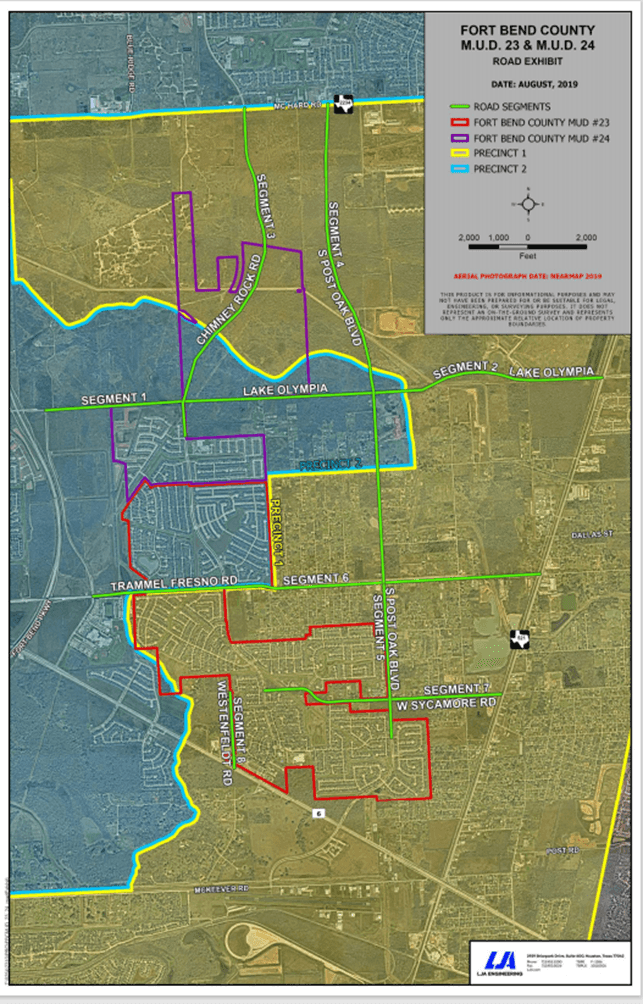

The road bond authorization will be used to supplement funds provided by Fort Bend County road bonds that will be used to facilitate road expansions on Chimney Rock Rd., S. Post Oak Blvd., and Lake Olympia Pkwy. The map below outlines the portions of the roads that the District would like to help fund.

The road projects include:

- Lake Olympia Segment 1

- Lake Olympia Segment 2

- Chimney Rock Rd Segment 3

- S. Post Oak Blvd Segment 4

Additionally, a portion of the road bond authorization may be utilized to fund the installation of sidewalks, signals, and trees along Trammel Fresno Rd.

What will the propositions on the ballot look like?

The language below will be on the ballot for residents of the District when they go to the polls or vote by mail for the May 1, 2021 election, asking voters to select one (1) option of either FOR or AGAINST:

This proposition is related to the future annexation of 781 acres and the water, sewer and drainage bond authorization needed to implement the infrastructure if such land is annexed.

This proposition is related to the bond authorization amount being sought by the District for the purpose of constructing roads. If approved, the bond funds will be used in conjunction with Fort Bend County bonds to help prioritize road projects and finance ongoing improvements near the District.

This proposition allows for the District to refund or refinance any of the bonds approved in Proposition B, if needed, in the future, if conditions are favorable, such as lower interest rates. This is a method of saving money in the future if the market conditions change and it is fiscally responsible to do so as a District.

What will the water, sewer, and drainage bond authorization be used for?

Water, sewer, and drainage bonds to fund future development will not be issued until the taxable property valuation on the ground is sufficient to pay the debt service on the bonds, so bonds sold to fund annexation development would not increase the tax rate or burden on existing residents of MUD 24. Future annexation development would result in more property owners contributing to the overall tax base and revenue collection of the District.

Why is it necessary to hold a bond election now?

Fort Bend County voters approved funding for these road projects in the November 2019 County road bond election. In order for the District to contribute its portion to these projects, the District must have bond authorization from District residents. With further development on the horizon, the proposed road projects would allow roads to be widened to accommodate added traffic, provide safe routes to major roadways, and enable first responders to better access residences in the District.

Can’t the District just pay for projects without issuing bonds?

The primary alternative to authorizing bonds is to fund all necessary projects on a "pay as you go" basis, likely requiring increases in water and sanitary sewer rates. The District is required to have funds in hand before it can proceed with a required project. Funding projects with water and sewer rates would likely require a dramatic increase in rates in the short-term in order to collect the required funds. This method places the financial burden for long term projects on current residents and could create delays and increase costs for the completion of large projects.

Authorizing the District to issue bonds would allow the Board to spread the costs of the necessary projects over numerous years and avoid the increases in water and sanitary sewer rates typically required by a "pay as you go" approach. This method spreads the cost for these projects among both current and future residents and businesses in the District and enables the District to complete necessary projects quickly.

How will Proposition B affect my tax rate?

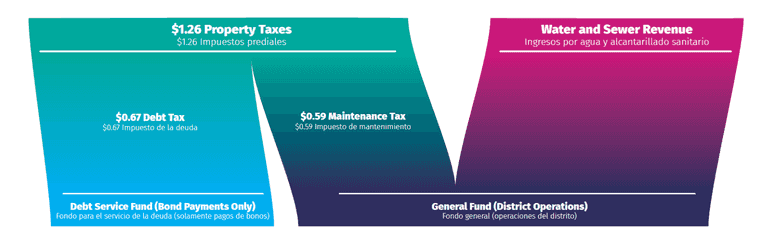

An increase to the District’s current $1.26/$100 property valuation tax rate is not expected if the District issues bonds for roads, given all the information on hand at this time and the financial forecast of the projects to be funded.

How are my taxes determined?

The District levies a total tax rate each year that has two components:

- The debt service tax rate, the proceeds of which can only be used to make payments on the District’s outstanding bonds; and

- The operations and maintenance tax rate (often referred to as O&M), the proceeds of which are deposited into the District’s General Fund and used, together with water and sewer revenue, to pay operating and maintenance expenses of the District.

These two components of the tax rate have changed over the years as the District’s debt service and operating expenses have changed.

I have more questions…

Good! The goal of the MUD 24 Board is to make information available to residents before the election.

Additional questions can be submitted using the “Contact Us” form on the District’s website: https://www.fbmud24.com/contact

Stay in Touch with Us

The MUD 24 Board wants to provide excellent communication and transparency. Stay up to date about the District by visiting the Election tab on the District website https://www.fbmud24.com/en/election-information.

Join us for the Community Education Webinar

The MUD 24 Board cordially invites residents to participate in the Virtual Community Election Education Events to discuss the upcoming bond election on the May 2021 ballot. These free events will feature exhibits showing the plans and goals for the District, and the Directors and consultants will be present to answer questions.

Attendees may select from the dates designated below:

Thursday, April 8th, 2021 at 7:00 p.m.

and

Saturday, April 17th, 2021 at 10:00 a.m.

After registering, a confirmation email containing information about joining the webinar will be sent.